Our Strategy

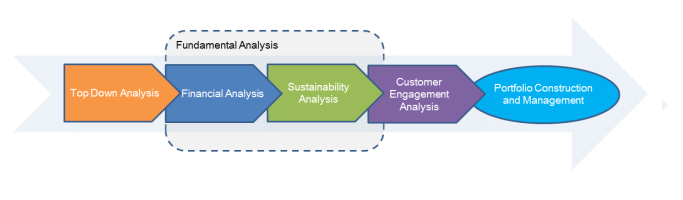

Equanimity Partners' investment process combines insights derived from macroeconomic themes, fundamental security analysis, sustainability analysis and customer engagement analysis. By evaluating a broader set of data than that associated with traditional financial analysis, we seek to identify sources of long-term value creation for the benefit of our partners and shareholders.

- Top Down Analysis

Begin with a global macro view to identify investment trends and themes the Investment Management Team believes represent the most compelling growth opportunities. - Financial Analysis

Identify companies determined to offer above-average relative growth rates, sound business models, strong competitive positioning and attractive valuations. - Sustainability Analysis

Evaluate companies’ Environmental, Social and Governance (ESG) performance in order to help us assess their long-term growth potential and risk profile. - Customer Engagement Analysis

Evaluate companies’ exhibited performance to engage customers through product and service delivery. Companies with long-term viability in the current operating environment must consistently delight their customers to maintain and grow customer base. - Portfolio Construction and Management

Within the parameters of Partnerships’ benchmark, build, monitor and periodically adjust a portfolio of securities and private investment opportunities based on investment themes and companies’ risk and return characteristics.